Welcome to our Market Update, written by our very own Capital Market experts. This blog is designed to give you a glance into the most important market events happening this week.

Market Commentary:

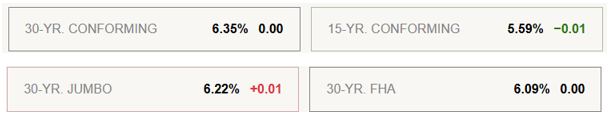

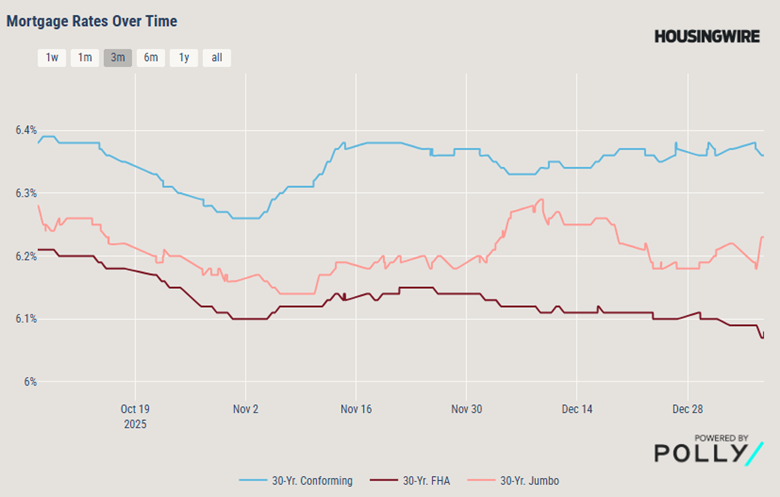

From January 2nd to January 8th, mortgage rates saw slight fluctuations, generally lower than last year but with varied weekly movement, while Treasury yields dipped slightly. Treasury Secretary Bessent urged the Fed to accelerate cuts, contrasting with some market expectations for fewer cuts in 2026. The Federal Reserve's key rate remains 3.5%-3.75%, with ongoing debate on future easing pace.

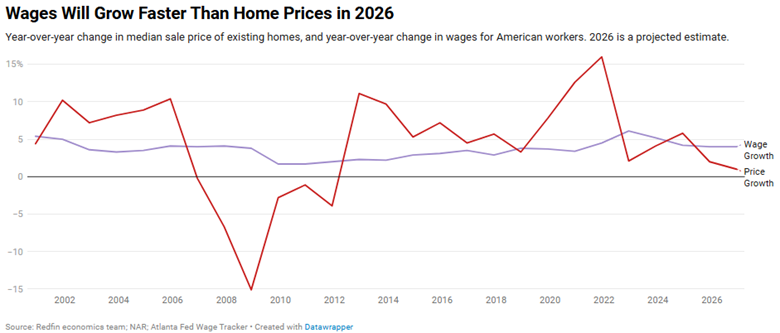

Overall, rates are stable to slightly lower compared to late 2025. Fed cuts from late 2025 continue to support affordability. Economic data remains the swing factor expect day‑to‑day rate noise. Buyer sentiment is improving, especially with rates holding near the low end of their 2025 range. Winter may offer strategic buying opportunities due to lower competition despite limited inventory.

Fed Watch: Target rate (in bps) possibilities, according to the CMEGroup (as of 01/08/2026 – 12:00 PM EST):

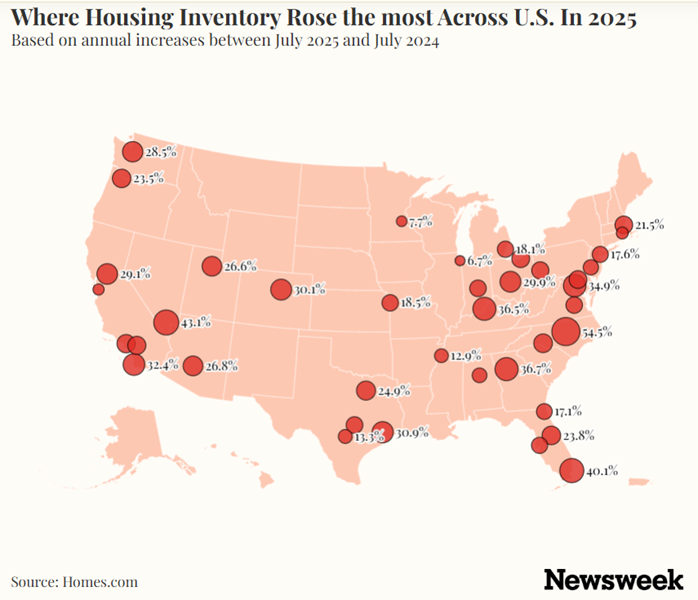

Map Shows Where Housing Inventory Is Rising Across US:

Pitiful Percentages:

Prior to the S&L crisis/recession of 1990, the bottom 80% of the US population were responsible for almost 45% of consumer spending, and the top 10% for slightly over 40%. Today, the bottom 80% are down to just 37% of spending while the top 10% are at 50%. These reversals make the rising unemployment rate and weakening wage growth among the lower classes less macroeconomically impactful than in the past. - Elliot Eisenberg, Economist

News You Can Use:

· Why complex stories, not low rates, won high-net-worth mortgage business | Mortgage Professional

· Trump says U.S. to ban large investors from buying homes

· Real estate agents say the housing market is starting to balance out

· Housing Payments Drop to Lowest Level in 2 Years As Mortgage Rates Decline

· U.S. Housing Market Risk Intensifies

· Mortgage Rates Start 2026 Near 2025 Lows

· Dethroned: Why Hartford Claims the Crown as 2026’s Hottest Market Over Buffalo

*Communication is intended for Industry Professionals only and not intended for Consumer Distribution

Interest rate and annual percentage rate (APR) are based on current market conditions as of 01/08/2026, are for informational purposes only, are subject to change without notice and may be subject to pricing add-ons related to property type, loan amount, loan-to-value, credit score and other variables. Estimated closing costs used in the APR calculation are assumed to be paid by the borrower at closing. If the closing costs are financed, the loan, APR and payment amounts will be higher. Contact us for details. Additional loan programs may be available. Accuracy is not guaranteed, and all products may not be available in all borrower's geographical areas and are based on their individual situation. This is not a credit decision or a commitment to lend. Actual interest rate, APR, and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property, and other factors as determined by HomeServices Lending, LLC. Not available in all states. Rate is as of 01/08/2026 and is subject to change at any time without notice. Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac’s economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Mac’s business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current, or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an “as is” basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution.

.png)