This Market Update is written by our Capital Market specialists each week to bring you insight into what's happening in the market and how it may affect mortgage rates and real estate trends.

Market Commentary:

Interest rates decreased for the week April 4th to April 10th. “Mortgage pricing is expected to be slightly lower today. The 10-year yield has declined from yesterday’s highs and is currently down a few basis points. Recent inflation data was softer than anticipated, and jobless claims figures were stable. Stocks are experiencing another sell-off this morning which is helping money going into bonds.” – Logan Mohtashami, HousingWire Lead Analyst.

In a notable sign of renewed activity in the housing market, mortgage applications climbed sharply last week, rising 20% from the prior week, this increase marks the highest level of application volume since September of last year, driven by both home purchase and refinance activity as interest rates dropped amid broader economic uncertainty.

Market Update Commentary from PHM Capital Markets on Recent Volatility (as of 4/9/2025):

Overnight, 10-yr TSY shot up to almost 4.5% dragging mortgage rates with it to mid to high 6%. Although this uptick is influenced by stronger-than-expected economic data and persistent inflation concerns, the primary reason for this volatility has been the recent trade policy shifts. After an intensely volatile few days, President Trump announced a 90-day pause on most tariffs, reducing them to a baseline of 10%. However, tariffs on Chinese imports have been significantly increased to 125% in response to ongoing trade tensions. China has retaliated with an 84% tariff on U.S. goods. These developments have introduced volatility into financial markets, affecting Treasury yields and, consequently, mortgage-backed securities. The Federal Reserve remains in a wait-and-see mode regarding interest rate adjustments. While rate cuts are still possible later this year, the timing is uncertain. The Fed Funds futures are pricing in about a 90% chance of at least 2 rates cuts in 2025.

Why does Trade tension impact mortgage rates?

When the U.S. imposes tariffs, especially steep ones like the recent 125% on Chinese imports, it raises the cost of imported goods. That contributes to inflation, which is already a hot topic. And inflation is enemy #1 for mortgage rates. When inflation rises, so do yields on Treasury bonds and mortgage-backed securities, which pushes mortgage rates higher. Investors often flock to “safe havens” like 10-yr TSY. This can push Treasury yields down temporarily (i.e. when the 10-yr hit a YTD low of 3.89% on Monday), but if inflation fears win out, rates can rise just as fast. The current tug-of-war between inflation and risk aversion is creating rate volatility, something we’re watching closely.

Fed Watch: Target rate (in bps) possibilities, according to the CMEGroup (as of 04/10/2025 – 12:00 PM EST):

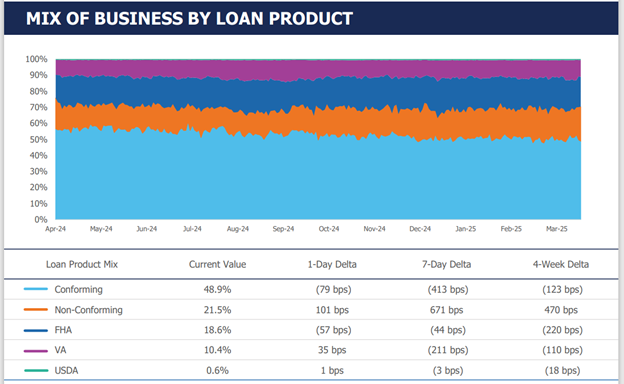

Market Review: Optimal Blue’s Production Metrics:

Eye on Housing – Almost half of the Owner-Occupied Homes Built Before 1980

Asking Rents Mostly Unchanged Year-over-year:

Comparing World Incomes, Adjusted for Inflation & Living Costs:

News You Can Use:

· Inflation rate eases to 2.4% in March, lower than expected; core at 4-year low

· FOMC Minutes: "Inflation was likely to be boosted this year"

· Weekly mortgage demand jumped 20% last week, as tariff volatility briefly tanked rates

· US home price insights – April 2025

· These 42 housing markets are seeing falling home prices

*Communication is intended for Industry Professionals only and not intended for Consumer Distribution

Interest rate and annual percentage rate(APR) are based on current market conditions as of 04/10/2025, are for informational purposes only, are subject to change without notice and may be subject to pricing add-ons related to property type, loan amount, loan-to-value, credit score and other variables. Estimated closing costs used in the APR calculation are assumed to be paid by the borrower at closing. If the closing costs are financed, the loan, APR and payment amounts will be higher. Contact us for details. Additional loan programs may be available. Accuracy is not guaranteed, and all products may not be available in all borrower's geographical areas and are based on their individual situation. This is not a credit decision or a commitment to lend. actual interest rate, APR, and payment may vary based on the specific terms of the loan selected, verification of information, your credit history, the location and type of property, and other factors as determined by HomeServices Lending. Not available in all states. Rate is as of 04/10/2025 and is subject to change at any time without notice. Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac’s economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Mac’s business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current, or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an “as is” basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution.

.png)